4 Reasons You Should Switch to Digital Banking

posted on Friday, November 20, 2020 in Financial Tips

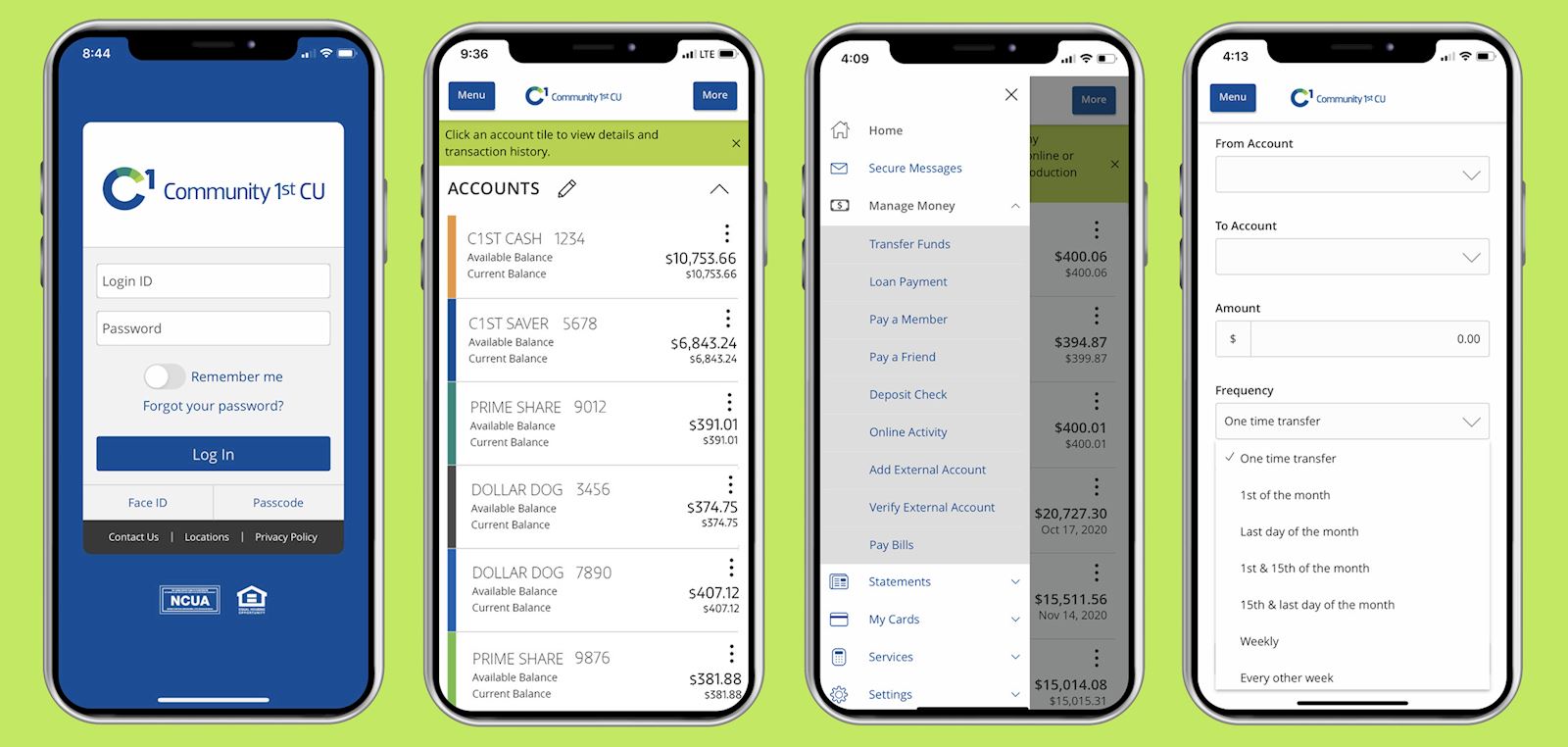

Not everyone has the time to spend more than an hour in line, paying bills or making fund transfers. Digital banking has become a lifesaver in this aspect as it allows users to make most of their transactions remotely. Read on to find out why many people are switching to this mode of banking:

Accessibility and Convenience

Digital banking gives you 24-hour access to your account. This means you don’t have to worry about making urgent or last-minute transactions before the credit union closes. You can also avoid missing deadlines by setting up recurring monthly payments. Here are other things that you can do:

- Transferring of funds between accounts

- Making loan payments

- Viewing your transaction history

- Viewing your statement of account

Added Security

Most mobile banking apps are equipped with a security feature called multi-factor authentication (MFA). It requires users to log into their account using two or more methods, like code verification and biometrics. You can also set up alerts, so you’ll be notified of any suspicious activities.

Easy Tracking of Finances

With your digital banking app, you can view your account balance and transaction history anytime. This is extremely helpful for budgeting purposes, as you can easily monitor your spending habits. You can also check whether everything charged to your account is actual purchases you made. So, if there are discrepancies, you can easily report them to your service provider.

Paperless Transactions

Documents such as financial statements, receipts, and checks can easily accumulate on your desk or drawer. By switching to digital banking, you can avoid the mess since everything is consolidated into one app. You also no longer have to worry about losing important files in the trash.

Stay on Top of Your Finances!

With Community 1st Credit Union’s digital banking app, you can manage your finances in the comfort of your home or office. You’ll have 24/7 access to various features, such as paying loans, viewing your statements, setting up account alerts, and transferring funds. If you have questions regarding our services, don’t hesitate to reach out to us today.